AUD/USD Strengthens on Hot Australian Inflation

AUD/USD Analysis

Today's data from Australia showed an acceleration in price pressures, as CPI rose to 4% y/y in May and the highest in six months. The country's central bank had appeared more worried over inflation earlier this month and policymakers had once again discussed a rate hike, even though they decide to hold at 4.35% [1]. Today's hot CPI repot strengthens prospects of a hike and a shift towards a less restrictive stance is pushed further away.

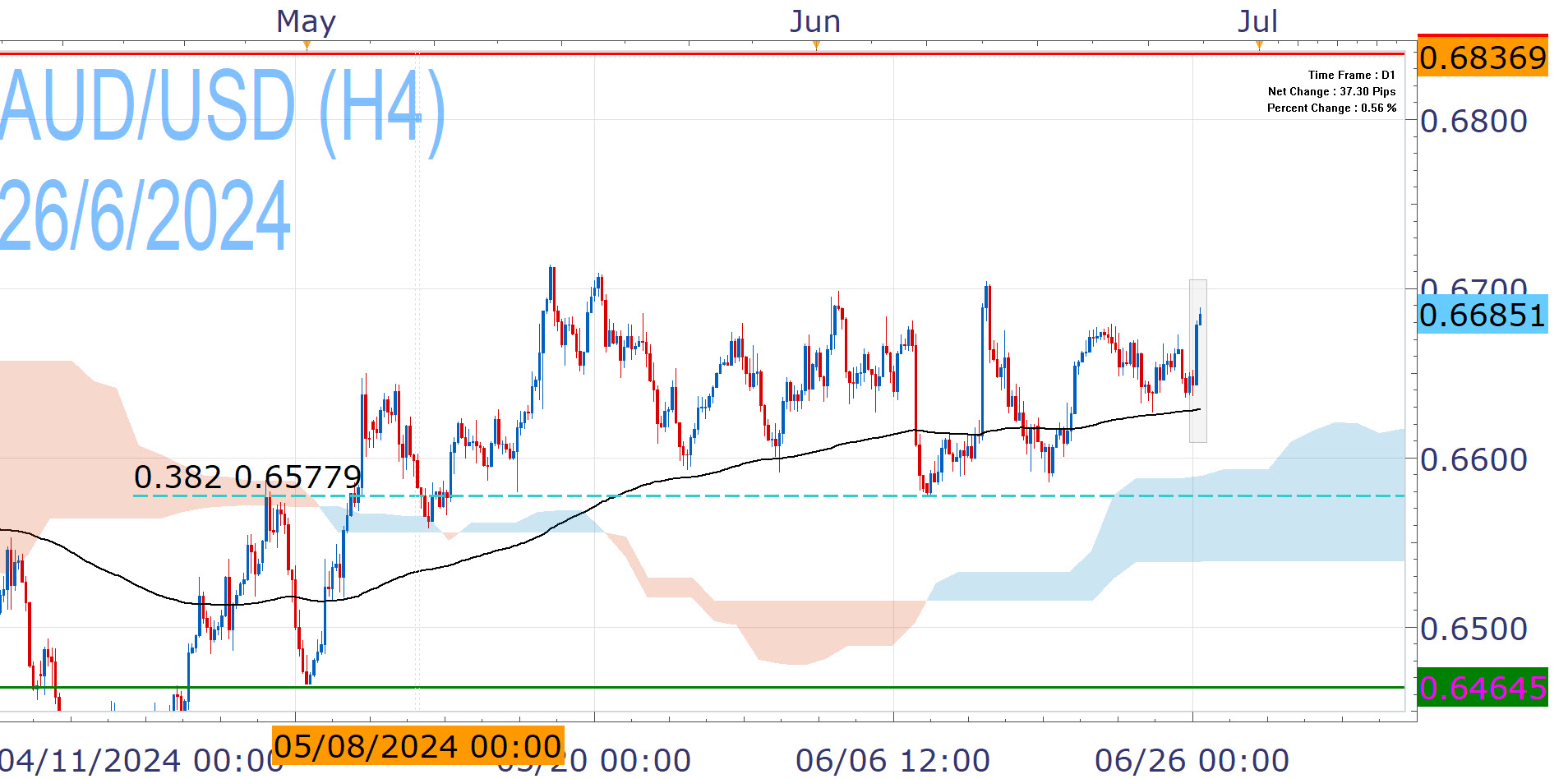

The US Fed meanwhile may be cautious towards a pivot, but markets still price in two rate cuts this year. This monetary policy divergence is beneficial for AUD/USD, which jumped after today CPI data. Above the EMA200 and having defended the pivotal 38.2% Fibonacci of the last leg up, bulls are in charge and on track for higher highs (0.6713). This would bring the 2024 highs (0.6839) in the spotlight, but this may prove elusive in the near term.

On the other hand, there is still a high bar for further tightening from the RBA and weak economic activity creates pressure for a less restrictive stance. Its US counterpart expects only one cut this year and has adopted a higher-for-longer narrative, supporting the greenback. An AUD/USD return below the EMA200 (balck line) would not be surprising, but sustained weakness is not easy given the favorable monetary policy differential and the downside is well protected technically.

Nikos Tzabouras

Senior Financial Editorial Writer

Nikos Tzabouras is a graduate of the Department of International & European Economic Studies at the Athens University of Economics and Business. He has a long time presence at FXCM, as he joined the company in 2011. He has served from multiple positions, but specializes in financial market analysis and commentary.

With his educational background in international relations, he emphasizes not only on Technical Analysis but also in Fundamental Analysis and Geopolitics – which have been having increasing impact on financial markets. He has longtime experience in market analysis and as a host of educational trading courses via online and in-person sessions and conferences.

References

| Retrieved 29 Jun 2024 https://www.rba.gov.au/media-releases/2024/mr-24-12.html |

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.