USD/JPY Hits 38-Year Highs on Fed Pivot Reluctance & Slow BoJ Normalization

USD/JPY Analysis

The Yen has suffered over past couple of years largely due to the central bank's ultra-loose policy setting. In a watershed decision in March, policymakers took a decisive step towards normalization, ending the negative rates regime and scrapping the yield curve control (YCC). This historic shift however, has failed to stop the currency's demise, as officials have maintained an accommodative stance. This month's lack of details around their intention to reduce the amount of asset purchases [1], kept the Yen under pressure.

On the other side of the Pacific, the US Fed is pedaling a higher-for-longer mantra, dictated by persistent price pressures and supported by robust labor market and strong economy. In fact, officials raised their PCE inflation forecasts this month, while downgrading their view on the appropriate policy path, now seeing just one rate cut this this year. [2]

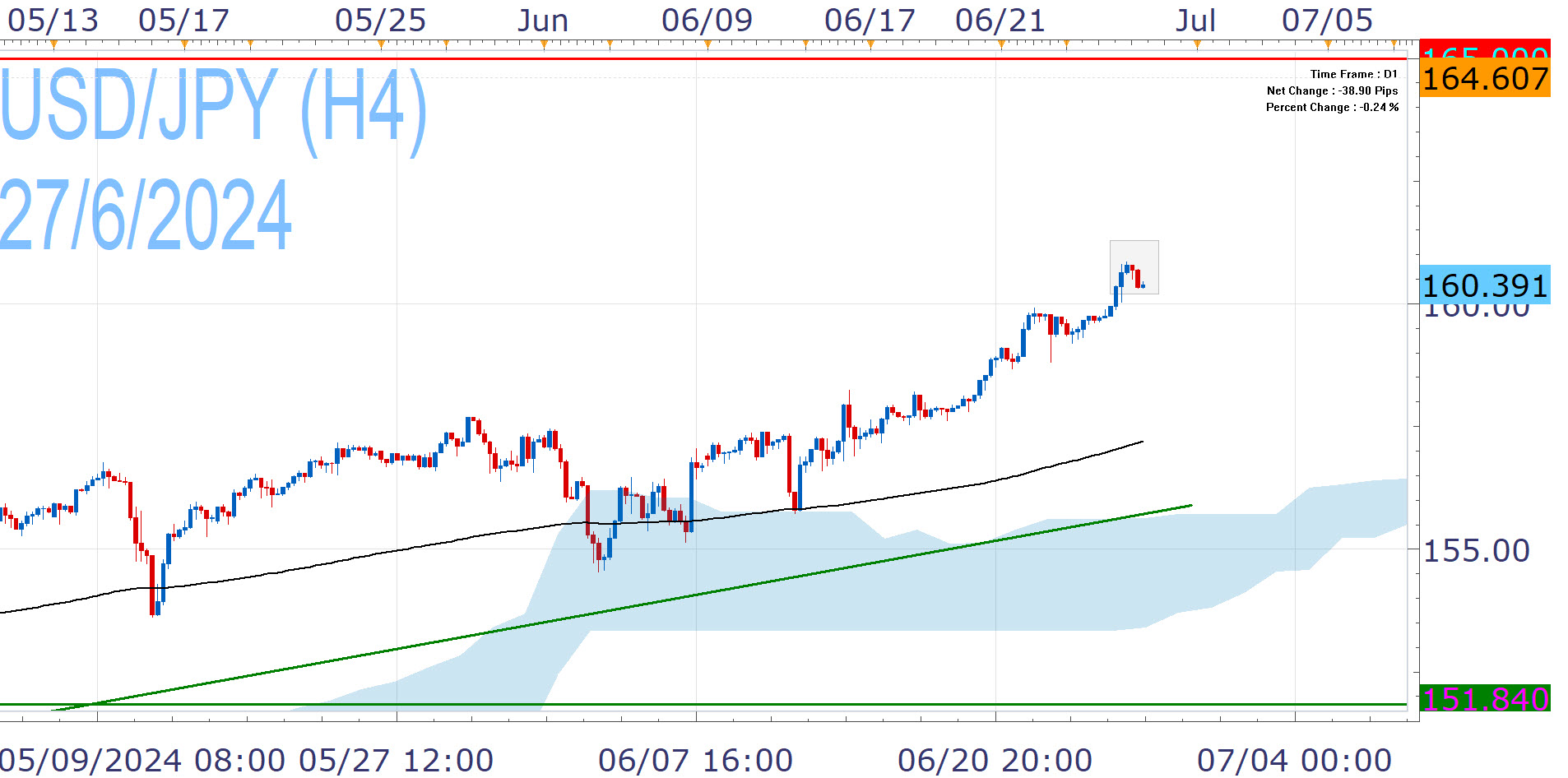

USD/JPY has been on a relentless rally due to the unfavorable mix, gaining more than 13% year-to-date. The advance was extended on Wednesday, as it surpassed its April peak on Tuesday, to hit the highest levels since 1986. This brings 165.00 in the spotlight, but this may prove elusive in the near term.

The move sparked a new round of verbal interventions by Japanese officials, scrambling to stop the Yen's slump. The country's top diplomat mr Kanda, escalated his rhetoric according to Reuters, signaling readiness to act [3]. Authorities have already spent nearly ¥10 trillion on FX operations this year (April 26 to May 29) [2] to support the ailing currency and the new high raises the chance of fresh FX intervention.

Furthermore, the Bank of Japan may have adopted a cautious stance towards normalization, but is still poised to reduce its bond buying and at least one more hike this year is reasonable. Its US counterpart on the other hand is reluctant to remove monetary restraint, but still expects to slash rates this year, whereas markets are more optimistic and price in two cuts.

This shift in monetary policy dynamics and risk of FX interventions can eventually weigh on USD/JPY and a pullback would be reasonable. Moves below the EMA200 (black line) that would pause the bullish momentum will need strong catalyst though and the downside appears well protected.

Nikos Tzabouras

Senior Financial Editorial Writer

Nikos Tzabouras is a graduate of the Department of International & European Economic Studies at the Athens University of Economics and Business. He has a long time presence at FXCM, as he joined the company in 2011. He has served from multiple positions, but specializes in financial market analysis and commentary.

With his educational background in international relations, he emphasizes not only on Technical Analysis but also in Fundamental Analysis and Geopolitics – which have been having increasing impact on financial markets. He has longtime experience in market analysis and as a host of educational trading courses via online and in-person sessions and conferences.

References

| Retrieved 27 Jun 2024 https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2024/k240614a.pdf | |

| Retrieved 27 Jun 2024 https://www.federalreserve.gov/monetarypolicy/fomcpresconf20240612.htm | |

| Retrieved 27 Jun 2024 https://www.reuters.com/markets/currencies/japans-top-currency-diplomat-escalates-warning-against-rapid-yen-falls-2024-06-26/ |

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.