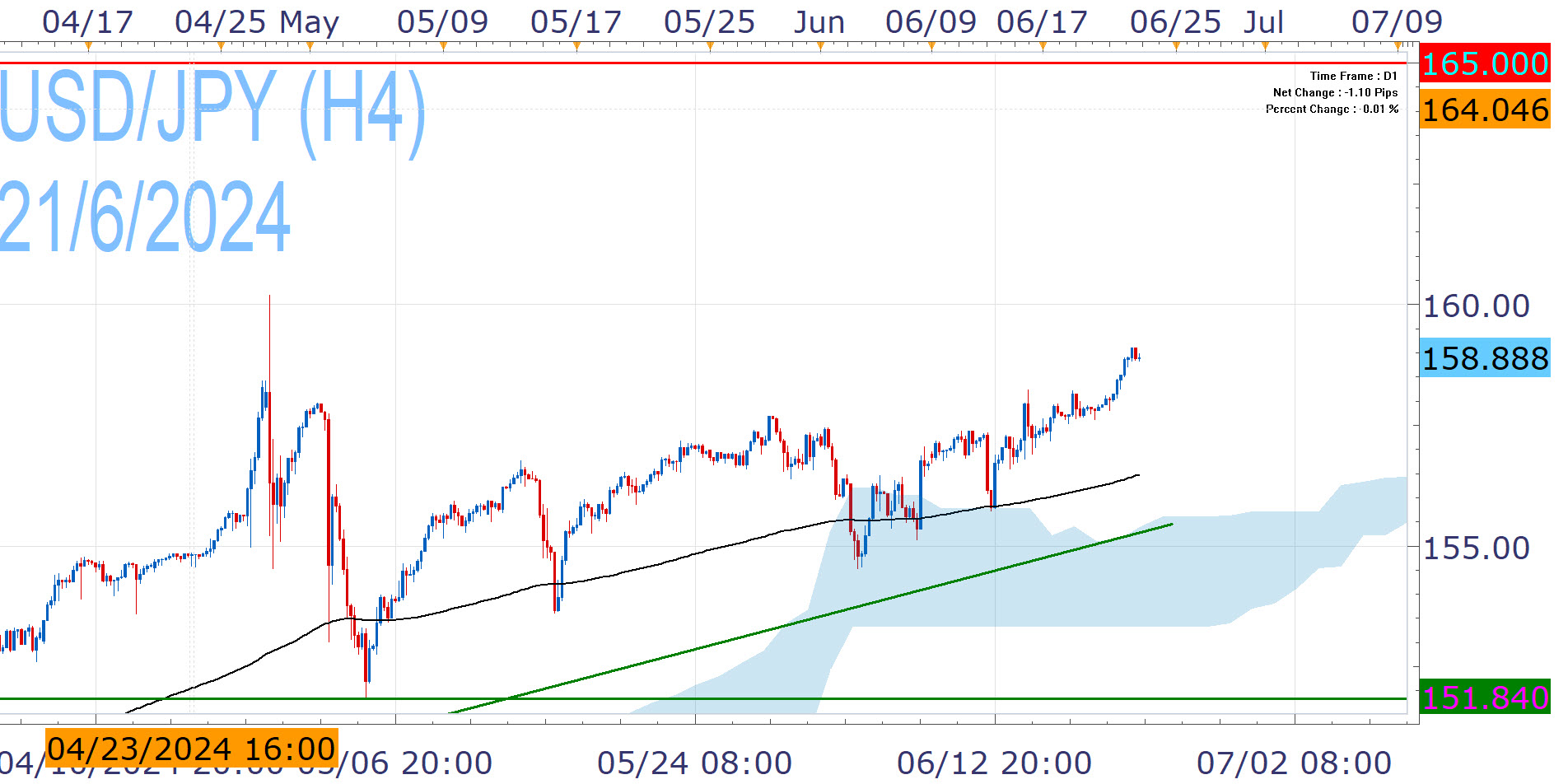

USD/JPY on Intervention Watch as Strength Persists

USDJPY Analysis

The US Fed has adopted a higher-for-longer stance, due to disinflation slowdown, resilient labor market and strong economy. Officials last week raised their PCE inflation forecast and adopted an even more cautious stance, now seeing just one cut this year. [1]

The Bank of Japan made a historic exit from negative rates in March, but maintains an accommodative stance. Although it announced its intention to scale back its bond buying [2], the lack of details casts doubts around the normalization process. At the same time, price pressures have moderated recently and today's mixed data added to the uncertainty. Core CPI picked up but less than anticipated and core-core eased for ninth straight month.

The Fed's reluctance to pivot is a source of strength for the greenback and the BoJ's slow progress on moralization sustains the Yen's weakness. As such, USD/JPY runs another profitable month and pushes for the April multi-decade peak (160.29), but bigger rally that would challenge 165.00 does not look easy.

This resurgence places the pair on intervention watch, with Japanese authorities having already spent almost ¥10 trillion on FX operations this year (April 26 to May 29) [3], trying to stem the Yen's demise. G7 Finance Ministers essentially gave the green light to such action last month [4] if targeted at containing excess volatility and the US yesterday may have added Japan in its Monitoring List, but stopped short of labeling it a currency manipulator. [5]

Risk of new FX intervention can contain the upside while the policy differential will eventually weigh on the pair. A pullback that would test the EMA200 (black line) would not be surprising, but there are multiple roadblock beyond. The Fed may expect just one cut, but markets price in two, in a more dovish outlook. Its Japanese counterpart moves slowly, but is set to reduce its bond buying and at least one more rate hike is reasonable within the year. Governor Ueda said that both this things could happen at the next meeting, according to Reuters. [6]

Nikos Tzabouras

Senior Financial Editorial Writer

Nikos Tzabouras is a graduate of the Department of International & European Economic Studies at the Athens University of Economics and Business. He has a long time presence at FXCM, as he joined the company in 2011. He has served from multiple positions, but specializes in financial market analysis and commentary.

With his educational background in international relations, he emphasizes not only on Technical Analysis but also in Fundamental Analysis and Geopolitics – which have been having increasing impact on financial markets. He has longtime experience in market analysis and as a host of educational trading courses via online and in-person sessions and conferences.

References

| Retrieved 21 Jun 2024 https://www.federalreserve.gov/monetarypolicy/fomcpresconf20240612.htm | |

| Retrieved 21 Jun 2024 https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2024/k240614a.pdf | |

| Retrieved 21 Jun 2024 https://www.mof.go.jp/english/policy/international_policy/reference/feio/monthly/20240531e.html | |

| Retrieved 21 Jun 2024 https://www.g7italy.it/wp-content/uploads/Stresa-Communique-25-May-2024.pdf | |

| Retrieved 21 Jun 2024 https://home.treasury.gov/system/files/136/June-2024-FX-Report.pdf | |

| Retrieved 01 Jul 2024 https://www.reuters.com/markets/asia/boj-may-raise-rates-july-depending-data-says-governor-ueda-2024-06-18/ |

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.